Apira

A future-focused investment framework for children and their families.

Apira explores how financial institutions can help families to build a fund for their children’s future – benefiting the child and the world they grow up in.

At the core, there are three main ideas:

- Reframing impact when it comes to investing.

- Providing a lifelong financial companion for the child.

- Enabling friends and family to contribute easily.

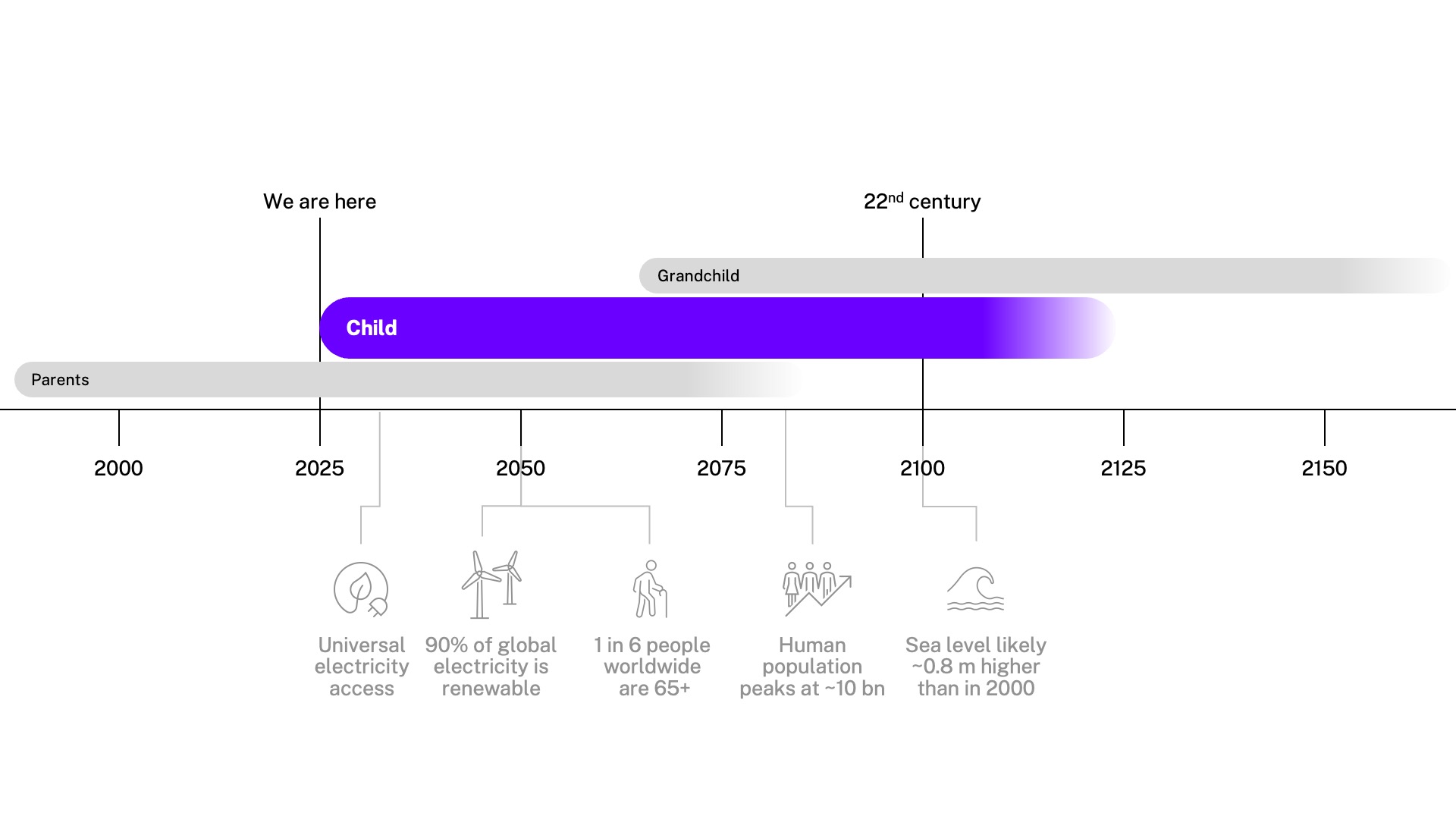

Children born today will come of age in the 2040s and retire in the 22nd century.

They’ll face realities and challenges we can hardly imagine.

We investigated how a financial product could prepare them for a world full of uncertainties.

Research shows that today’s generation of parents is focused on investing with impact – while their children are part of a generation born into challenges. Apira aims to bridge this gap by enabling parents to have meaningful impact while supporting them in purposeful parenting.

Research

Key insights that shaped Apira

First of all, the Beyond Money and Navigating Parenthood research provided us with key insights that set the stage for Apira:

- The journey into parenthood is a window for long-term thinking.

- Financial well-being is more than numbers.

- Motivation to save is high, but execution is hard.

- Money habits are inherited.

Secondly, our interviews with people across 25 countries revealed clear patterns in people’s general attitudes towards investing:

- Knowledge gap: People don’t reject investing per se, but they miss plain language and a step-by-step entry path.

- Trust and safety first: Caution is the default, because loss aversion is high – and banks are often seen as self-interested.

- Guided start: Most people don’t want to begin alone. Social proof, like recommendations from family or friends, helps.

- Friction hinders action: Apart from small budgets, what hinders people from investing are complexity, too many choices, and fear of “locking money away”.

- Values and clarity: Many people want to invest aligned with their values, some prioritise returns – but foremost, people want to know where their money goes. Therefore, transparency remains key.

Challenge

Traditional cash savings are eaten up by inflation.

Investing is often praised as the alternative but our research shows that many people, especially those navigating financial pressure and busy lives like parents, experience investing as (too) risky and complex. As a result, they struggle to take the first step, even when they know saving alone won’t be enough.

On top of that, every kind of investment has an impact on social cohesion and the planet the child will live in. Too often, investments boost practices that harm the future well-being of the child, now and in decades to come.

We developed Apira as a conceptual framework to respond to these challenges, and to inspire meaningful financial products for people.

Apira combines three key ideas:

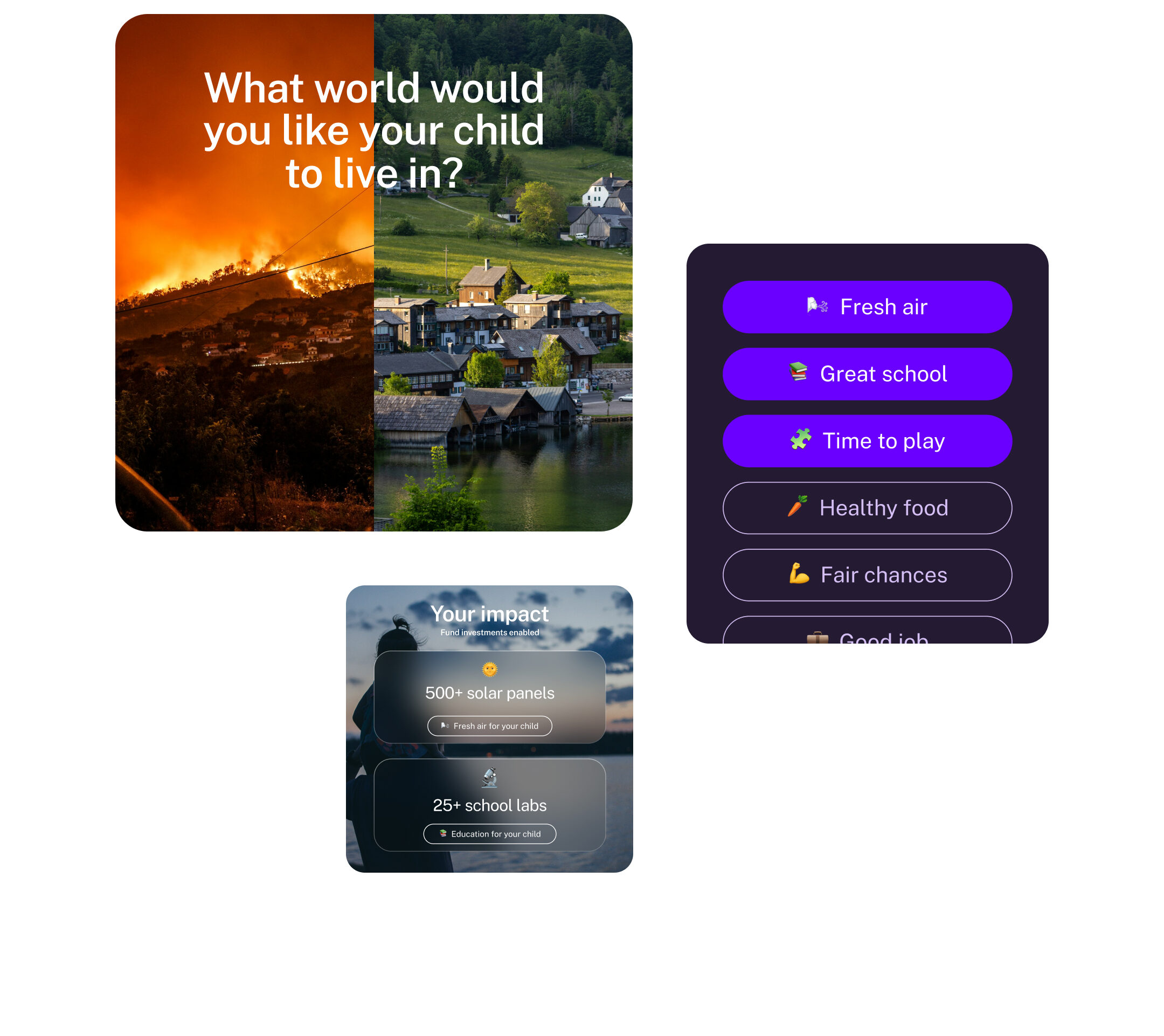

Reframing impact

Shape the child’s future well-being

Shifting from finance jargon and investment strategies to asking a simple question, and taking it from there: What world would you like your child to live in?

- Channel part of the child’s Apira account into local impact projects or businesses

- Link investing with tangible outcomes

- Guided by what matters most – the family’s values

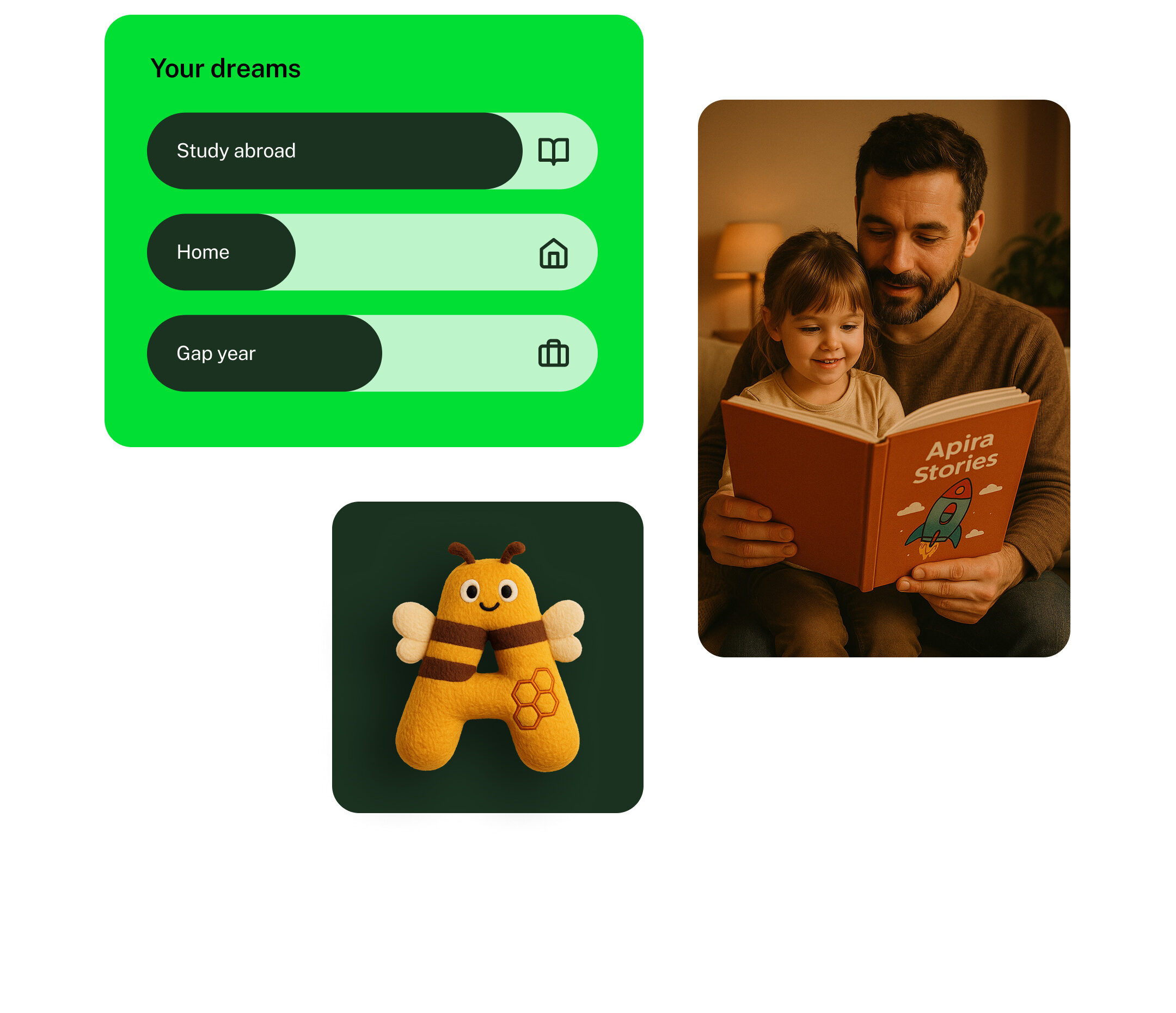

Lifelong companion

A lifelong financial companion for the child

Shifting from a passive investment account to a companion that grows alongside the child – celebrating milestones, sparking curiosity, and turning money lessons into real-life experiences.

- Blends digital tools with real-world moments

- Evolves with the child’s age and passions

- Builds lifelong confidence in money and decision-making

Easy contribution

Making it easy for family and friends to contribute

Shifting from disposable gifts to contributing to something that grows with the child. Building a child’s future isn’t a solo act – loved ones can take part, one small contribution at a time.

- From disposable gifts to contributions that grow with them

- Equip parents’ employers to participate with contributions

- Motivate the child to contribute themselves when they are old enough

Disbursement

An opportunity for financial education

A chance to grow for the child: When they come of age, the money in the fund becomes available to them.

Apira allows parents to choose between two main unlock options:

- One-time: The default – the child gains access to the fund when they turn 18.

- Step-by-step: A gradual unlock, the child receives some pocket money in their late teenage years, to support them on their journey to become financially responsible. Full access to the fund is then granted no later than 21.

Life isn’t linear, so there also needs to be an option to access the fund in case of emergencies or unexpected surprises.

Communication

Speaking people’s language

A key part of Apira is clear, human language. Therefore, communication around such a conceptual product should strategically:

- Talk about life rituals and avoid money jargon

- Highlight the payoff in future memories and everyday well-being

- Keep language relatable to different user groups

Apira explores what could be possible.

The conceptual nature of the framework serves as an inspiration, not as a finalised case ready to implement.

The thinking behind Apira already sparked conversations in different areas of financial institutions:

- Impact investing and social finance, exploring opportunities on how to make investments locally tangible.

- Financial literacy and how to amplify it for the next generation.

- Redefining gifting in other applications such as savings.

- Insurances and how to support young people in investment matters.

- Asset management and how financial products can be orchestrated in the future.

Initial reactions

- “I really like the reframing impact part – it’s much more tangible.”

- “I love the idea of having a product that grows together with my child and evolves.”

- “The financial sector should start and not wait for governments [to implement].”